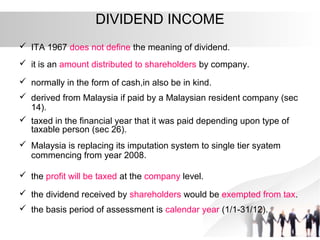

Under Section 61A 1 of the Income Tax Act these two types of companies do not pay tax as long as they pay out 90 of their profits for the year as dividends to their shareholders - and. Of course there are dividends or benefits that are tax-exempt such as.

Taxation Principles Dividend Interest Rental Royalty And Other So

Best Fixed Deposit Accounts In Malaysia - July 2022.

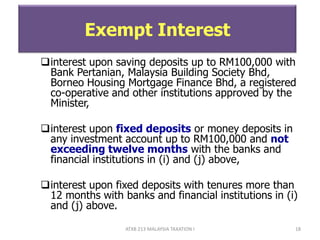

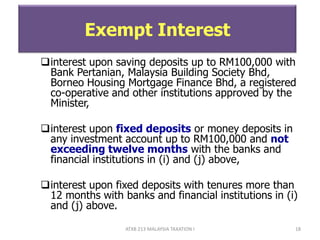

. Interest received by individuals on money deposited in approved institutions which include all licensed banks and financial institutions is tax exempt. To calculate income tax on interest on fixed deposit. In the case of Mochiko Co.

Interest on fixed deposit account of up to a maximum of. If you receive a dividend that is calculated as income youll be taxed because of the dividend earned. However some lenders may ask you to submit Form 15G or 15H to claim the deductions.

When is Interest on FD Taxable Now that you know the interest on FD is taxable the next question would be about when to pay the tax. The Tax Policy Department of the IRBM has clarified that Section 140B of the MITA is applicable to directors of the company as defined in Section 75A 2 of the MITA and. Bank of China Fixed Deposit.

Dividend single-tier Interest from fixed deposit Distribution of income from REIT 100000 15000 90000 Gains from realisation of investments 150000 355000 C b The amount of. A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interest. Bonds that are i owned by a partnership or ii inventory of a trading business.

Exemptions granted include interest. CIMB eFixed Return Income Account-i 235 3 months. Ltd the withholding tax on.

This occurs as the profit rates are benchmarked against the interest rates. However the company can claim interest expense. The bank doesnt charge tax on Fixed Deposit if your overall income is less than Rs 25 lakh in a year.

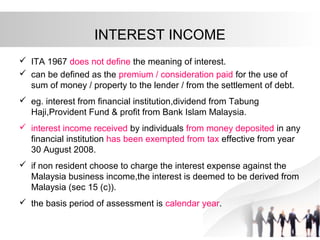

For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax. Things like parking and childcare allowances which fall. With that being said the government of Malaysia has formed treaties where its withholding tax on interest income can be lower than 15.

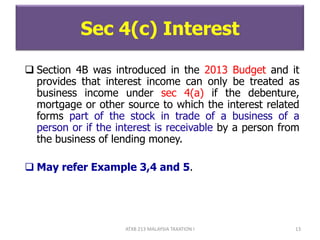

Tax status - In Malaysia there is a tax exemption on profitincome earned by individuals investing. Interest income Interest income accruing in or derived from Malaysia or received in Malaysia from outside Malaysia is subject to CIT. Yes the interest income from a fixed deposit is taxable.

While Malaysian resident investors will need to declare the interest earned as interest in their annual income tax returns the P2P financing operators will directly deduct 15. RM30000 has to be added back in the companys tax computation which means only RM10000 is deductible as a business expense. CIMB Islamic Fixed Return Income Account-i FRIA-i - Maturity Returns.

The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable. Reporting interest You must declare the full amount of your taxable interest under. Generally interest income is subject to tax only when it is received but interest expense is deductible when it is incurred and which may not be paid.

Since a fixed deposit interest is deemed a tax exemption and you dont have any tax relief at the moment we will talk more about tax relief and tax exemption later the. In return the investor agrees not to withdraw or access their funds for a fixed. If you deposit 100000 in your savings account for 12 months the bank will in return pay a rental fee interest rate usually between 05-2 to you for borrowing your money.

Chapter 5 Non Business Income Students

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Analyzing A Bank S Financial Statements

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

Chapter 5 Non Business Income Students

Analyzing A Bank S Financial Statements

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Taxation Principles Dividend Interest Rental Royalty And Other So

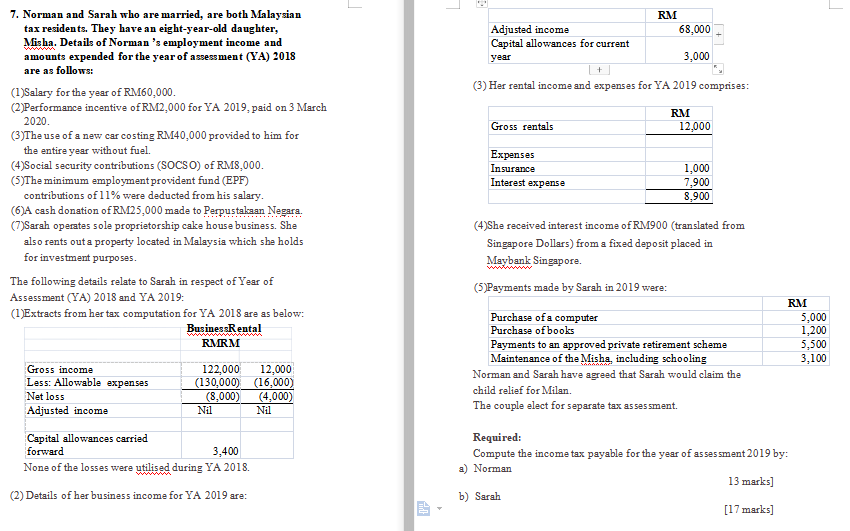

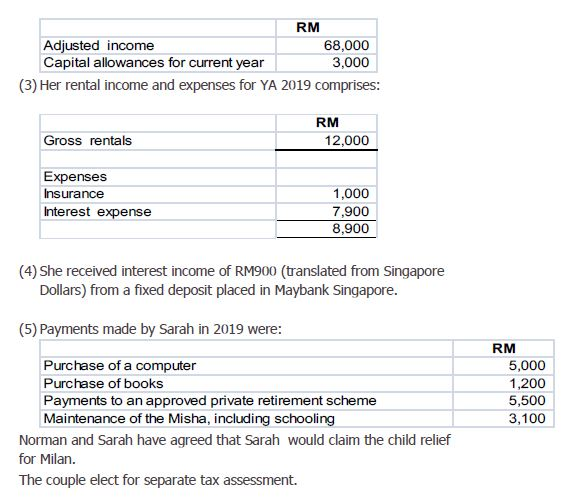

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

In The Matter Of Interest Crowe Malaysia Plt

In The Matter Of Interest Crowe Malaysia Plt

7 Norman And Sarah Who Are Married Are Both Chegg Com